Friday, February 10, 2012

The Learning Experiences Emerging From The Carnival Ship Disaster Off Italy’s West Coast

Posted by Peter Quennell

Value migrations force better systems upon us, and so the human race progresses…

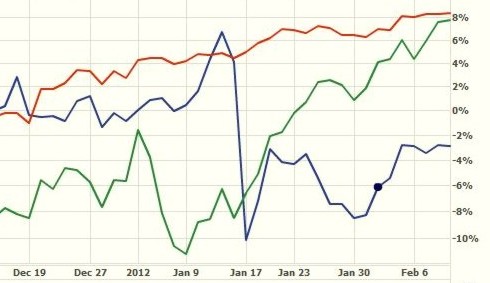

Check out first what seems to be happening to value as a result of the Costa Concordia wreck, as reflected in the stockmarket chart just below. Stockmarkets and currency exchange rates constitute the value votes of a lot of watchful people trying to decide where to put their money.

Italy has no independent currency any more, so Italy sorely lacks that other very useful value indicator and safety valve. But stockmarket behavior is telling us a lot both about Italy and about the Carnival cruise line.

In the past three months during which the main American index, the Dow-Jones (red curve), gained an okay 8 percent, the Italian stockmarket index (green curve) gained a very impressive 30 percent.

The main news out of Italy in those three months was (1) the austerity plan, which in theory is setting the stage for future growth (toward which there was some cynicism), and (2) the recovery from the wreck of the Costa Concordia (toward which the doubts were even greater).

You can see a slight blip down in the green curve immediately after the wreck, but then Italy continued with speedy value migration inward. It seems fair to say “Well done Italy. You’ve received votes of international confidence on both fronts.”

Carnival, however, rather less-so.. The blue curve is the stock price of Carnival Cruise Lines and it’s still down about 12 percent since the wreck happened which is about $3 billion off Carnival’s market valuation. All cruise lines seem to have taken something of a hit and are likely to encounter other heat to make sure they all keep improving.

Check out now what is happening to systems.

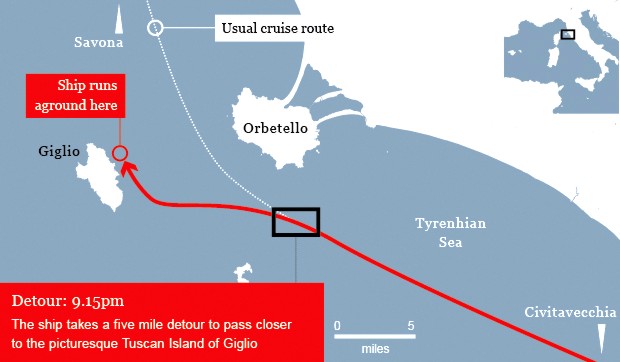

It seems clear that the captain was steering the ship while he was a bit tiddly while showing off to what increasingly appears to have been his girlfriend by his side. By international and Carnival rules (1) the captain should not have been drinking, (2) he should not have been five miles off course, (3) the Moldovan dancer should not have been on the bridge, and (4) the captain should have been a lot more careful in his navigating.

So four systems at least were violated.

Then when the ship was beached - there is some uncertainty as to whether this was deliberate or whether the captain was just putting the ship in shallow water - (5) damage to ship bulkheads was much more than expected, adding to the high number of deaths, (6) the lifeboats were almost impossible to launch, and (7) the evacuation procedures almost totally broke down - in part because there had been no evacuation drill before the ship left the port of Rome, and in part because the captain went awol and was already standing on the beach.

That is far from an exhaustive list and systems changes implemented after the 9/11 attack numbered up in the hundreds - military responses, building techniques, city preparedness, corporate distribution of their people and physical assets. We will see the same happen here.

Right now we are watching what appear to be two very efficient systems cutting in and doing their work. One is the recovery of the oil from the ship and then the ship itself. And the other is the Italian legal system, which is going to be kept busy with this one for years.

There is increasing evidence that the single Moldovan dancer and the married captain were having some sort of affair. She briefly admitted as much, telling a court she loved him, and the searchers and divers may have found her effects in his cabin.

He may now face 2,500 years in prison to reflect on the importance of respecting systems and the value of peoples’ lives. .

Comments

Peter! Wow! Stunning!

Thanks for your succinct summary.

It is almost what I suspected in the beginning…

The lady is suffering from “I am a pretty girl syndrome” and the man is facing bravely his middle age crisis. (I wish my marriage photo was half as good!)

The story is old. As old as the Adam and Eve. Blame nature or biology!

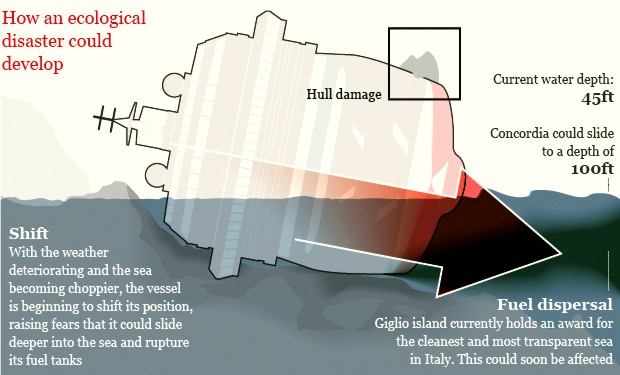

The oil may not leak - what appears from the diagram - and it is possible to take out the oil safely without spilling. However, when about half the oil has been removed the ship becomes lighter and may start slipping. A safer way is to pump water in and then collect the floating oil that comes out.

Hi Cardiol. Thanks. As you know, everybody - everybody - gets to vote on value, through their purchases and their investment choices. These can be far more powerful weapons in their hands than political votes these days.

Value migrations are much larger, faster and more pervasive than most people realize, and they can punish terribly those who mess about. The whole world was punished terribly in 2008-2009 (global value dropped some trillions of dollars) because of the nefariousness of bankers and mortgage people in creating phoney value and the politicians and the rest of us who bought into this idea of a free lunch.

The US, European and Japanese stock indexes now are approximately where they were twelve years ago so we are being punished at national levels for squandering more than a decade. Job numbers are only where they were back then, and few firms, industries, regions and whole countries right now create net positive value.

In your twin professions you surely have encountered and mastered plenty of systems and been involved in upgrading quite a few. Fun, right?! Although most systems are still “invisible” to most people, they are the guts of development, and the UN is for the most part a huge system enhancement apparatus (not a very good one, which is why I moved to the outside).

Systems are costly and difficult to install right, and once there and optimized, they have a tendency to paralyze us (what is happening to advanced economies now) or bite back.

http://www.amazon.com/Why-Things-Bite-Back-Consequences/dp/0679747567

There is a way forward from this, but not widely understood (starting small, create new entities alongside with all systems fresh).

http://www.amazon.com/Innovators-Solution-Creating-Sustaining-Successful/dp/1578518520

Widespread computerization (computer systems optimized within wider systems) began with the Bill Gates/Steve Jobs generation of the 1980s and 1990s, but it was not until the early part of the 2000s after several TRILLION dollars spent that computerization came out ahead and became a net plus.

Master these concepts at the individual level, and people can break into very high paying professions. Master them at the global level, and the world could grow 2-3 times as fast.

Welcome to the professional universe Meredith seemed intent on occupying. She was studying exactly the right subjects and she had her career sites set on exactly the right hubs from which to help to make things come right.

Hi Chami. You will know that that top people tend to be narcissistic and so do dancers (it gets to be hard wired in them) and their relationship was probably something of an orgy of self-gratification and showing-off. Such people often face a cruel retirement, and both here were nearing their ends.

Yes there’s lots to be learned from the YouTube simulations of how smart these recovery techniques have become. Coastal communities near Giglio are on a knife-edge right now, but with luck they will not long-term be affected.

The incident sure has promoted that marine area off Tuscany as a place to go visit. I for one never knew about it. The clearest seawater in the entire Mediterranean, and there seems a lot to see down there.

Value seeping out of the cruise industry could in a bizarre way have contributed to the wreck.

It’s expanded fast over the past 20 years and was given an accidental boost by Bin Laden - people feel safer on ships than on wandering around Africa or the Arab countries which have been having value-growth and violence problems.

NYC once had one marine terminal, now it has three - one on the Hudson, one in Brooklyn (Red Hook) and one on the New Jersey side of the harbor (Bayonne). They can see a dozen cruise ships every weekend taking on their huge passenger loads. Some of these ships like the Queen Mary and the Scandinavia Line ships (the Princesses) are bigger than the Concordia.

When they arrive on their maiden voyages a lot is done to make the event flamboyant - air horns, fireworks, fire ships pumping geysers in the air. The cruise lines hope this will create an identity in peoples’ minds.

Now with the economies in the doldrums especially in Europe the cruise lines are in heavy marketing mode and flamboyant captains doing flamboyant things may not have been very much frowned upon.

***

If you get interested in using stock curves as value proxies to see if your country or industry or company is doing well the place to start is here:

That is a basic Yahoo interactive chart with just the best American stock average or index loaded (the Standard and Poors 500).

Google the ETF (exchange tradeable basket fund) of any country or region or industry or company that interests you. The Stock-Encyclopedia site lists hundreds. Here is their macro Europe list.

http://etf.stock-encyclopedia.com/category/european-etfs.html

Copy the ETF’s 3-4 letter symbol and paste it into the “Compare” box of the Yahoo chart. Here are Italy and Switzerland and Emerging Markets (China, India, Brazil, etc) as a whole now added in:

Hit the 5Y button below to increase the period to 5 years. Then drag to the left the left axis of the sliding scale below to show you say the past 10 years.

Gulp!! The sucesses and failures will really stand out.

Switzerland is doing best in Europe (now with Sweden) while Italy is down 50%. Meanwhile, China, India and Brazil are up 300% despite a nasty and hopefully unrepeatable crash in 2009.

Not like we didnt get any warning!! For 10 years emerging markets have been eating Europe’s and the US’s lunches. With youth unemployment in Europe >>> 30% and even 50% as a result expect more frustration, more drugs and more murders.

All of the above could and should be taught to everyone in high school. Also the basics of seeing and putting in systems. Several weeks at that age would transform most peoples’ career possibilities.

They’d then be able to run rings around most prime ministers and most central bankers.

@Peter,

We are living in interesting times. I do not understand anything about the market forces and I have deep ingrained suspicion about the whole thing. I have always thought that the market is run by the mafia (a group of like minded people with vested self-serving interests). Forgive me if I sound arrogant, but I have always considered both Italy and France to be communist countries in the western Europe (it is my favourite joke and don’t flame me, please)!

My view is somewhat like this: the economy is crumbling but the people are not! People are on the street protesting the illegal (do I mean immoral?) things being done to them. They are the real victims and they are the only ones who matter and they need to be heard. We are still treating them as disposable tissues!

If you have a few minutes to spare, please take a look at the following YouTube video (a colleague sent me the link):

http://www.youtube.com/watch?feature=player_embedded&v=zDZFcDGpL4U

The world cannot support hundred Steve Jobs or Bill Gates (or bernie Madoff either). We simply do not have the resources. But should we kill the dreamers? Happiness does not cost money. They just want to be simply happy with a simple life.

Don’t get me wrong. I have nothing against the riches. But just tell me what you are going to do with the building frustrations all over the world?

They’d then be able to run rings around most prime ministers and most central bankers.- The circus is about the begin. Only problem is that it is not going to be entertaining.

Man can believe the impossible, but man can never believe the improbable. —Oscar Wilde

Hi Chami. With a bit of luck things will come right in the precise way that you would seem to like. We’re in year 42 of global learning curves and paradigm change (subject of that YouTube) that hopefully will only take 60 years to play out!

The milestones since 1970 when the UN passed a resolution saying “okay developing countries, manage all your own growth and aid” are extremely revealing. There was a huge turn away in Asia in the 1990s from what is called the Washington Consensus of the US and IMF and World Bank toward the more mixed model appropriate to their level.

Even the Wold Bank grudgingly said yes: http://www.amazon.com/East-Asian-Miracle-Economic-Research/dp/0195209931

That model then sent China, India, the little tigers and most of the rest of Asia roaring on their way. In parallel, the three areas of relevant science (value, systems and process) to make it all keep going on and on had to progress through many wrong turns to where now they all essentially have it right.

Next step is hopefully for countries at “higher” levels to see this knowhow fully operationalized. Economies on their backs like some of those in Europe may be the first to make the final decisive moves. The IMF and national leaders have actually said countries need to go this way (“austerity is not enough”) and all that I describe is not really controversial, and very powerful when put in a lot of peoples’ hands.

Any wealth that is over-concentrated in a very few hands (whether corporations or billionaires) has people in this game very bothered, because those few hands tend to become very cautious and defensive, and the small creative efforts that lead to new value streaks dont stand very much of a chance.

PS Chami, properly functioning and firmly managed stockmarkets do send relatively cheap capital to those that deserve it the most. Most money in stockmarkets is from pension funds and mutual funds - in effect, from us.

But you are right I think to be very suspicious at individual company level, and I would treat most companies’ stock prices and pronouncements with about as much trust as snakes.

ETF’s are baskets of dozens or hundreds of companies, and unless there is mass delusion (which has happened 2-3 times in each decade), their curves do tell us usable truths.

After the 2008-2009 crash which many of us saw coming years ahead, US controls and requirements for more info were put in place. And year by year people get more educated and empowered.

Have you ever seen the funny movie “Groundhog Day”? Where a guy has to relive a day till he gets some key things right? Essentially we are experiencing a very big global case of that.

Where next:

Click here to return to The Top Of The Front PageOr to next entry Costa Concordia: Amid Continuing Environmental Concerns The Captain Is Charged With More

Or to previous entry Did The Captain Being Drunk Delay Evacuation And Cause The Probable 30-Plus Deaths?